THE CASE FOR HEALTHCARE REAL ESTATE INVESTMENT IN THE SOUTHEASTERN UNITED STATES

The southeastern United States is renowned for its forecasts of sunshine and happiness, but it’s getting crowded. The lovely weather of the Southeast doesn’t only make for great golf, it draws people to move and stay here, and population growth benefits almost all investment theses. As populations increase, so does their demand for goods and services. Housing, retail and medical services fall squarely in that camp.

According to a recently published article1 by the Census Bureau’s Journey-to-Work and Migration Statistics Branch, “In 2018, about 1.2 million people moved to the South from another region, while only about 714,000 moved from the South to another region. This resulted in a net gain of about 512,000 people. If movers from abroad are included, the net gain from migration to the South is about 959,000 people.”

However, not all population growth is created equal. Growth among younger cohorts benefits schools, recreation leagues and toy stores, while growth among older cohorts benefits industries such as housing, travel, pharmaceuticals and healthcare.

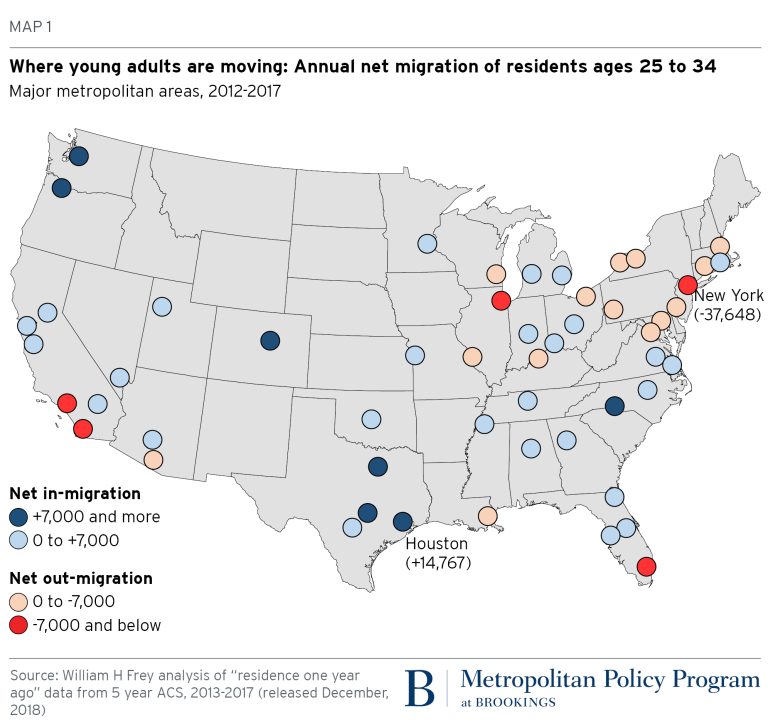

Per a report released in early 2019 by The Brookings Institution, a number of major metropolitan areas were magnets for seniors who did move. As shown on the map below with Flagship’s primary market area highlighted, senior migrant gainers in 2012-2017 were heavily represented in the Sun Belt. Just 20 of the nation’s major metropolitan areas exhibited positive gains in senior migration.2

Though healthcare services are increasingly moving toward virtual health – telemedicine and telehealth represented, for example, by apps on your iPhone – care delivered in conventional bricks and mortar real estate will be a mainstay for several more decades. Health systems are shifting care from their inpatient environments, i.e., hospitals, to outpatient settings, such as medical office buildings, and this trend has been on a serious uptrend for years. Through population health management strategies, hospitals are driving more healthcare services off their main campus. Why? Inpatient reimbursements from payors are declining and occupancy costs to deliver care in medical office buildings are far lower than those in hospitals. Improvements in clinical procedures such as outpatient surgeries and pharmacological solutions are advancing at a rapid pace. Healthcare providers are driven to enhance the patient experience as patients are forced to spend more on their own healthcare.

Care, convenience and cost are the “holy trinity” of healthcare. And the force behind these is a seismic shift from care volumes to care quality, or outcomes. Outpatient is good, but outsourced isn’t happening. This pendulum of “moving off campus” has not – and shows no signs of – being able to swing so far as “moving offshore.” While telemedicine is real and growing, and transcription services and radiology interpretation could be shipped to other, lower-cost countries, there does not currently exist a wide scale, remote solution to replace face-to-face clinician-to-patient interaction for most higher-acuity health needs. Orthopedics, allergists, pediatricians, ophthalmologists, and dentistry are but a sampling of specialties wherein patients and doctors still achieve better outcomes through in-person interactions. Which bodes well for healthcare real estate.

How much healthcare real estate is out there? Per Revista’s 2019 Outlook for Medical Real Estate3, the national medical office market consists of 1.3 billion square feet valued at $372 billion, as of 12/31/2017. Approximately 189 million square feet of that medical office product is located in the southeastern US, valued at $52.0 billion.

Revista’s data indicates that over 50% of medical office buildings nationally are at least 20 years old. Some 20+ year old buildings are fine, and can be retrofitted and upgraded and continue to deliver environments that support excellent care. But some are obsolete (no room or capacity for technology, wiring, and medical equipment). Some floorplates aren’t conducive to practices today. Some don’t have enough parking or meet certain building codes and standards.

Healthcare providers are reliable real estate tenants. Hospital systems and physician practices continue to grow and consolidate. The industry is tough, but the growth and consolidation model provides some economies and strengths, which contribute to a provider’s ability to pay its bills more easily. Another strategy utilized by many health systems and providers that contributes to greater efficiencies and flexibility is to sell, or monetize, their real estate and lease it back and, secondarily, to repurpose or reposition some of their real estate. Monetization transactions free up their invested capital and give them freedom from the responsibilities of healthcare real estate ownership and the ability to focus on their core mission of delivery excellent care to patients. Repurposing or repositioning real estate allows for greater efficiencies and utilization both on and off their hospital campuses. These strategies have the added benefit of providing investors with leased product to buy.

While many physician practices have been acquired by hospitals and health systems, some physicians believe they can provide better care if they remain independent. Just as with health systems, independent physician groups’ primary goal is to deliver the highest quality care to their patients. Real estate is simply a (capital intensive) conduit to delivering that care. Leasing space or entering into sale-leasebacks of their real estate can provide those physician groups with capital needed to support or expand their operations, while allowing healthcare-centric real estate professionals to optimize their real estate. For both health systems and independent providers, rent as a percentage of operating expenses in outpatient medical facilities is relatively low, so groups don’t often fail to pay rent.

And we like tenants who stay put. Revista’s latest investor survey reports a national average retention rate for medical office tenants of 80.1%. Generally, MOB tenants invest a lot of money into their space and it’s expensive to relocate it or abandon it. Also, patients get accustomed to the routine of going to the same place (especially if they are older). When was the last time your doctor or dentist moved?

In summary, favorable trends will continue to support investing in Southeast U.S. healthcare real estate: consolidations among healthcare providers; the continuing shift to provide services in outpatient settings; increasing demands for care driving industry growth as the population ages and expands; stable tenancy; an aging supply of facilities requiring replacements; and patient demand for better outcomes and convenience at lower costs.